Discover 5000 years of money’s evolution. How money started, why its value changes, what gives it worth, and its digital future in 2026. Complete guide with historical references.

The Incredible Journey of Money: Clay Tablets to Cryptocurrency

Introduction: What Is Money Really?

Before we dive into history, let’s understand what money actually is. According to economist William Stanley Jevons (1875), money serves four primary functions:

- Medium of Exchange: Eliminates the “double coincidence of wants” problem

- Store of Value: Can be saved and retrieved later

- Unit of Account: Provides common measure of value

- Standard of Deferred Payment: Allows borrowing and lending

2026 Perspective: Money is evolving into something even more fundamental – a system of trust and information exchange.

Part 1: The Origins – Before Money Existed

10,000 – 5,000 BCE: The Barter System Era

How Society Functioned:

- Direct exchange of goods and services

- Farmer trades wheat for blacksmith’s tools

- Shepherd exchanges wool for pottery

The Fundamental Problem:

The “Double Coincidence of Wants” – both parties needed what the other had, at the same time, in the right quantities.

Historical Evidence:

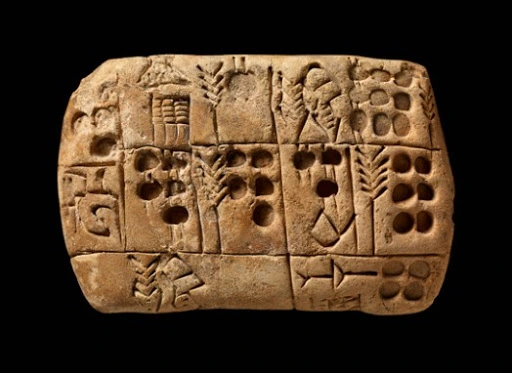

- Mesopotamian clay tablets (4000 BCE) show records of commodity exchanges

- Ancient Egyptian tomb paintings depict grain-for-cattle trades

- Biblical references to barter systems in early societies

The Transition Period: Commodity Money

5,000 – 3,000 BCE: Natural Objects as Currency

Different civilizations developed their own “proto-money”:

| Civilization | Commodity Money Used |

|---|---|

| Mesopotamia | Barley (standardized in shekels) |

| Ancient China | Cowrie shells |

| Pacific Islands | Rai stones (huge limestone discs) |

| Africa | Cattle, salt blocks |

| Americas | Cacao beans, woven cloth |

Why These Items?

- Scarcity: Hard to obtain

- Durability: Long-lasting

- Portability: Easy to transport

- Divisibility: Could be divided into smaller units

- Recognizability: Widely accepted

Part 2: The First Real Money – Metal Coins

7th Century BCE: Lydia’s Revolutionary Invention

Location: Kingdom of Lydia (modern-day Turkey)

Date: Around 650-600 BCE

Invention: The first standardized metal coins

Key Features:

- Made of electrum (natural gold-silver alloy)

- Standard weight and purity

- Stamped with official marks (lion’s head symbol)

- Guaranteed by the Lydian kingdom

Historical Significance:

- Herodotus wrote about Lydian coinage in “Histories”

- Enabled long-distance trade expansion

- Created first price standardization

Global Spread of Coinage:

500-300 BCE: Different Approaches Emerged

- Greek City-States:

- Silver drachma became standard

- Different cities minted their own coins

- Alexander the Great standardized coinage across empire

- Roman Empire:

- Denarius (silver) became primary coin

- Aureus (gold) for large transactions

- Extensive coinage facilitated Roman trade networks

- Ancient India:

- Punch-marked silver coins

- Standardized by the Mauryan Empire

- Influenced Southeast Asian coinage

- China:

- Initially used bronze tool money (spades, knives)

- Transitioned to round coins with square holes

- Used for over 2,000 years

The Problem with Metal Money:

Three Major Issues:

- Weight: Heavy to transport large amounts

- Security: Vulnerable to theft during transport

- Supply Limitations: Dependent on mining discoveries

Part 3: Paper Money – The Chinese Innovation

7th Century CE: The First Paper Currency

Location: Tang Dynasty China

Invention: “Flying money” – certificate of deposit

How It Worked:

- Merchants deposited metal coins with government

- Received paper certificates

- Could redeem certificates elsewhere

- Reduced robbery risk during travel

11th Century: True Paper Money Emerges

Song Dynasty Innovation:

- First government-issued paper currency (Jiaozi)

- Printed using woodblock printing technology

- Initially fully backed by metal reserves

- Problem: Over-issuance led to inflation

Marco Polo’s Account (13th Century):

In “The Travels of Marco Polo,” he described Chinese paper money:

“All these pieces of paper are issued with as much solemnity and authority as if they were pure gold or silver… and indeed everyone takes them readily.”

Europe’s Slow Adoption:

Why Europe Resisted Paper Money:

- Strong tradition of metal coinage

- Lack of centralized authority for backing

- Initial failures of early paper experiments

17th Century Change:

- Swedish Stockholms Banco issued first European banknotes (1661)

- Bank of England established (1694) and issued notes

- Colonial America used “bills of credit”

Part 4: The Gold Standard – Modern Money’s Foundation

1816-1914: The Classical Gold Standard

Britain Leads the Way:

- 1816: Britain officially adopts gold standard

- Gold sovereign becomes standard coin

- Other countries gradually follow

How It Worked:

- Currency convertible to fixed amount of gold

- Governments held gold reserves

- Exchange rates fixed between currencies

- Automatic adjustment mechanism: Trade imbalances self-corrected

The Interwar Period & Collapse:

1914-1944: Breakdown and Chaos

- WWI forced countries off gold standard

- Competitive devaluations in 1930s

- Great Depression worsened by monetary instability

Bretton Woods System (1944-1971):

- U.S. dollar tied to gold ($35/ounce)

- Other currencies tied to dollar

- Created IMF and World Bank

- Collapsed in 1971 when Nixon suspended convertibility

Part 5: Fiat Money – The Current System

What Is Fiat Money?

Definition: Currency that has value because government says it does, not because it’s backed by physical commodity.

Key Characteristics:

- No intrinsic value

- Legal tender status

- Government monopoly on issuance

- Value based on trust and acceptance

How Modern Money Works:

Federal Reserve/ Bank of England/ Bank of Canada

↓

Commercial Banks

↓

You (through loans, deposits, digital transfers)

Fractional Reserve Banking:

- Banks keep only fraction of deposits as reserves

- Create money through lending

- Money multiplier effect expands money supply

Part 6: What Gives Money Its Value?

The Four Pillars of Monetary Value:

1. Government Decree (Legal Tender Laws)

- Must be accepted for debt payment

- Tax payments must be in official currency

- Example: “This note is legal tender for all debts, public and private”

2. Scarcity & Supply Control

- Central banks control money supply

- Prevents excessive inflation

- 2026 Challenge: Digital currencies bypass traditional controls

3. Public Trust & Confidence

- Belief that others will accept it

- Confidence in stability of value

- Historical Example: Hyperinflation destroys trust (Weimar Germany, Zimbabwe)

4. Network Effects

- More users = more valuable

- Self-reinforcing adoption

- Digital Example: Credit cards, mobile payments

Why Money’s Value Changes: Inflation/Deflation

Key Drivers of Value Change:

| Factor | Effect on Money Value | Example |

|---|---|---|

| Money Supply Increase | Decreases (inflation) | Quantitative easing |

| Economic Growth | Can increase or decrease | Strong economy may appreciate currency |

| Interest Rates | Higher rates increase value | Central bank rate decisions |

| Political Stability | Increases value | Stable governments have stronger currencies |

| Trade Balances | Surplus increases value | Export-heavy economies |

| Speculation | Can dramatically change value | Currency markets |

Part 7: Essential Requirements for Money

The 6 Essential Characteristics:

1. Durability

- Must withstand wear and tear

- Historical: Gold lasts, paper deteriorates

- 2026: Digital money is perfectly durable (but needs secure storage)

2. Portability

- Easy to carry and transfer

- Evolution: Coins → paper → digital → instant transfers

- Future: Brain-computer interface transactions?

3. Divisibility

- Can be divided into smaller units

- Examples: Dollar → cents, Bitcoin → satoshis

- Importance: Enables transactions of all sizes

4. Uniformity

- Each unit identical and predictable

- Critical for: Trust and standardization

- Problem: Counterfeiting threatens uniformity

5. Limited Supply

- Scarcity creates value

- Gold: Limited by mining

- Fiat: Controlled by central banks

- Crypto: Algorithmically limited

6. Acceptability

- Widely recognized and accepted

- Requires: Network effects, trust, legal status

- Challenge: New currencies face adoption hurdles

What Sustains Money Systems?

Four Essential Supports:

1. Legal Framework

- Laws governing issuance and use

- Contract enforcement

- Dispute resolution mechanisms

2. Financial Infrastructure

- Banking system

- Payment networks (Visa, SWIFT)

- Clearing and settlement systems

3. Monetary Policy Institutions

- Central banks

- Regulation and oversight

- Crisis management capabilities

4. Technological Systems

- Minting/printing facilities

- Digital infrastructure

- Security systems (anti-counterfeiting)

Part 8: Digital Revolution – Money in 2026

The Current Digital Landscape:

Three Layers of Modern Money:

Layer 1: Physical Cash

- Still exists but declining

- 2026 Stat: Only 8% of transactions in developed economies (IMF projection)

Layer 2: Bank Digital Money

- Checking/savings account balances

- Digital transfers, debit cards

- Dominant system today

Layer 3: New Digital Forms

- Cryptocurrencies

- Central Bank Digital Currencies (CBDCs)

- Stablecoins

- Mobile money (M-Pesa, etc.)

Central Bank Digital Currencies (CBDCs):

2026 Status:

- China: Digital yuan fully operational

- USA: Digital dollar in advanced testing

- EU: Digital euro pilot programs

- UK: Britcoin research phase

Potential Impacts:

- Faster, cheaper transactions

- Enhanced monetary policy tools

- Financial inclusion improvements

- Concerns: Privacy, surveillance, disintermediation of banks

Cryptocurrency Evolution:

From Bitcoin (2009) to 2026:

First Generation (2009-2015):

- Bitcoin: Digital gold/store of value

- Focus: Decentralization, censorship resistance

Second Generation (2015-2020):

- Ethereum: Programmable money/smart contracts

- Focus: Utility, applications

Third Generation (2020-2026):

- Scalability solutions (Layer 2s)

- Institutional adoption

- Regulatory clarity emerging

- 2026 Trend: Hybrid systems (crypto + traditional)

Part 9: Is Money Necessary? Philosophical Perspective

Arguments FOR Money’s Necessity:

1. Efficiency Argument

- Eliminates barter’s inefficiencies

- Reduces transaction costs

- Enables specialization and trade

2. Time Coordination Argument

- Allows saving for future

- Enables investment in long-term projects

- Facilitates intergenerational transfers

3. Information Function

- Prices convey information about scarcity

- Guides resource allocation

- Enables economic calculation

4. Social Coordination

- Enables complex economic cooperation

- Facilitates division of labor

- Supports large-scale societies

Arguments AGAINST Current Money Systems:

Criticisms:

- Inequality reinforcement: Money begets money

- Short-termism: Discounting future values

- Environmental costs: Resource-intensive systems

- Alienation: Reduces relationships to transactions

Alternative Visions:

- Gift economies (indigenous traditions)

- Time banking (hour-for-hour exchange)

- Resource-based economies (The Venus Project)

- Fully automated luxury communism

The 2026 Reality:

Money isn’t disappearing, but it’s transforming. We’re moving toward:

- Multiple coexisting systems

- Increased digitization

- Greater programmability

- More personalized monetary experiences

Part 10: The Future of Money – 2030 and Beyond

Predicted Developments:

2026-2030: Hybrid Systems

- CBDCs alongside cryptocurrencies

- Traditional banking plus DeFi

- Cash for specific use cases

2030-2040: Programmable Money

- Money with built-in rules

- Example: Food stamps that can only buy nutritious food

- Example: Climate funds that track carbon impact

2040+: Post-Scarcity Systems?

- If automation creates abundance

- Basic income systems

- Reputation/attention economies

Long-Term Philosophical Questions:

Will Money Become Obsolete?

- If scarcity disappears: Possibly

- If human nature changes: Unlikely

- Practical reality: New forms will emerge

What Might Replace Money?

- Universal Basic Income + Resource Allocation

- Social Credit Systems (controversial)

- AI-Managed Resource Distribution

- Blockchain-Based Reputation Systems

Historical References & Sources

Academic Sources:

- Graeber, David (2011) “Debt: The First 5,000 Years” – Challenges conventional money history

- Ferguson, Niall (2008) “The Ascent of Money” – Comprehensive financial history

- Weatherford, Jack (1997) “The History of Money” – Accessible overview

Archaeological Evidence:

- Lydian coins at British Museum

- Song Dynasty paper money artifacts

- Mesopotamian clay tablets at Louvre

Economic Theory:

- Adam Smith (1776) “Wealth of Nations” – Money’s role in trade

- John Maynard Keynes (1936) “General Theory” – Modern monetary theory

- Milton Friedman (1963) “A Monetary History of the United States” – Importance of money supply

2026 Projections:

- IMF Digital Money Reports (2024-2025)

- Bank for International Settlements CBDC Research

- World Economic Forum Future of Money Studies

Conclusion: Money’s Enduring Journey

Key Takeaways:

1. Money Is Constantly Evolving

- From barley to Bitcoin in 5,000 years

- Each form solved problems of previous systems

- Change is constant and accelerating

2. Trust Is the True Foundation

- Whether gold, paper, or digital

- Trust in issuer, system, and other users

- 2026 Challenge: Maintaining trust in digital systems

3. Technology Drives Monetary Innovation

- Metallurgy → coins

- Papermaking → banknotes

- Cryptography → digital currencies

- Next: Quantum computing, AI, neural interfaces

4. Money Reflects Society

- Ancient kingdoms: Royal coinage

- Nation-states: Fiat currencies

- Digital age: Global, decentralized systems

- Future: Personalized, programmable money

Final Thought:

Money began as a simple solution to barter’s limitations. It evolved through millennia of innovation, conflict, and adaptation. As we stand in 2026, we’re witnessing another great transformation. The fundamentals remain—trust, utility, acceptance—but the forms are changing dramatically.